delayed draw term loan definition

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Refers to the loans that the Lender has agreed to be made available to the Borrower under a Revolving Credit Facility or a Delayed Draw Term Facility that the Borrower has either not drawn or has drawn and repaid.

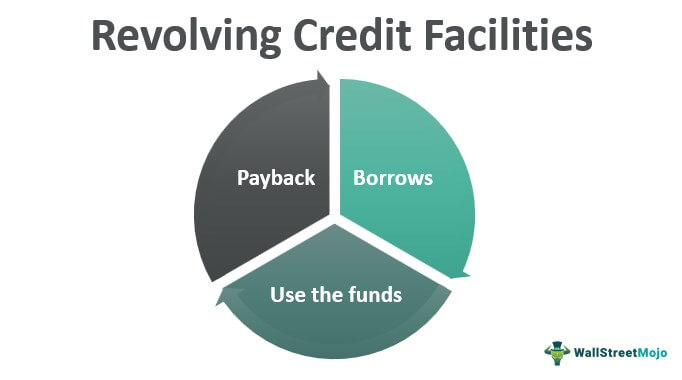

Revolving Credit Facilities Definition Examples How It Works

Another name for a Tranche B Term Loan.

. Delayed Draw Term Loan A Loan that is fully committed on the closing date thereof and is required by its terms to be fully funded in one or more installments on draw dates to occur within three years after the closing date thereof but which once fully funded has the characteristics of a. Their appeal is one reason borrowers have moved toward the private debt market sometimes at the expense of syndicated loans. Another name for the Exchange Act.

Đây là thuật ngữ được sử dụng trong lĩnh vực Ngân hàng Khái niệm cho vay cơ bản. A delayed draw term loan also referred to as DDTL is a particular feature of a term loan where the lender disburses pre-approved loan amount based on a pre-determined time schedule. Thuật ngữ tương tự - liên quan.

A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. Delayed Draw Term Loan means any Loan that is fully committed on the initial funding date of such Loan and is required to be fully funded in one or more installments on draw dates to occur within one year of the initial funding of such Loan but which once such installments have been made has the characteristics of a term loan. DELAYED DRAW TERM LOAN CREDIT AGREEMENT.

A draw period is the amount of time you have to withdraw funds. Delayed Draw Term Loan means any Loan that is fully committed on the initial funding date of such Loan and is required to be fully funded in one or more installments on draw dates to occur within one year of the initial funding of such Loan but which once such installments have been made has the characteristics of a term loan. Delayed-draw term loans or DDTLs of up to two years are standard features of financing from private credit providers.

This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the Guarantors party hereto from time to time together with the Borrower each a Credit Party and collectively the Credit Parties the lenders party hereto from time to time the Lenders and. Another name for a Negative Assurance Letter. Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions.

An accordion feature in a line of credit allows a business to increase that line of credit if necessary often to obtain more working capital or emergency cash. The lenders approve the term loans once with a maximum credit limit and charge variable interests on them. A draw is a payment taken from construction loan proceeds made to material suppliers contractors and subcontractors.

137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. A loan term is the length of time it will take for a loan to be completely paid off when the borrower is making regular payments.

Provided that any Loan as to which no further. Unless the context requires otherwise i any definition of or reference to any agreement instrument or other document herein shall be construed as referring to such. Another name for a Rule 10b-5 Representation.

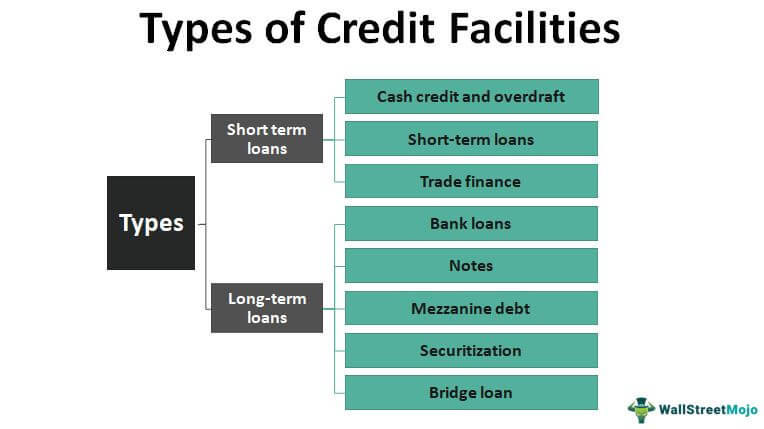

Loans can be short-term or long-term notes. The withdrawal periods are also determined in advance. Danh sách các thuật ngữ liên quan Delayed Draw Term Loan Definition.

Delayed Draw Term Loan Definition là Trì hoãn Draw vay Term Definition. The time it takes to eliminate the debt is a loans term. Delayed Draw Term Loan Definition là gì.

The accordion feature is an added. The revolving loans are approved for the short-term usually up to one year. 3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10 test since the commitment is not funded on the modification date.

Another name for the Securities Act. Another name for a Tranche A Term Loan. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified time period ie the reporting entity gets to choose the date that the debt funds within a.

But loan terms can also refer to the features of a loan that you agree to when you sign the contract. May consist of immediately funded or delayed-draw term loans or of revolving credit commitments May be implemented as either a new credit facility or as an upsizing of an existing credit facility May be implemented via an amendment agreement an incremental assumption agreement or an amendment and restatement of the existing credit. That means the borrower doesnt have to pay them from personal funds while.

Another name for the Investment Company Act. For example you can have loan withdrawals taking place every three months or six months or at other intervals agreed by the lending institution. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional debt and thus the additional.

With a DDTL you can withdraw funds several times from a predetermined loan amount. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS.

Types Of Credit Facilities Short Term And Long Term

Financing Fees Deferred Capitalized Amortized

The Benefits Of Long Term Vs Short Term Financing

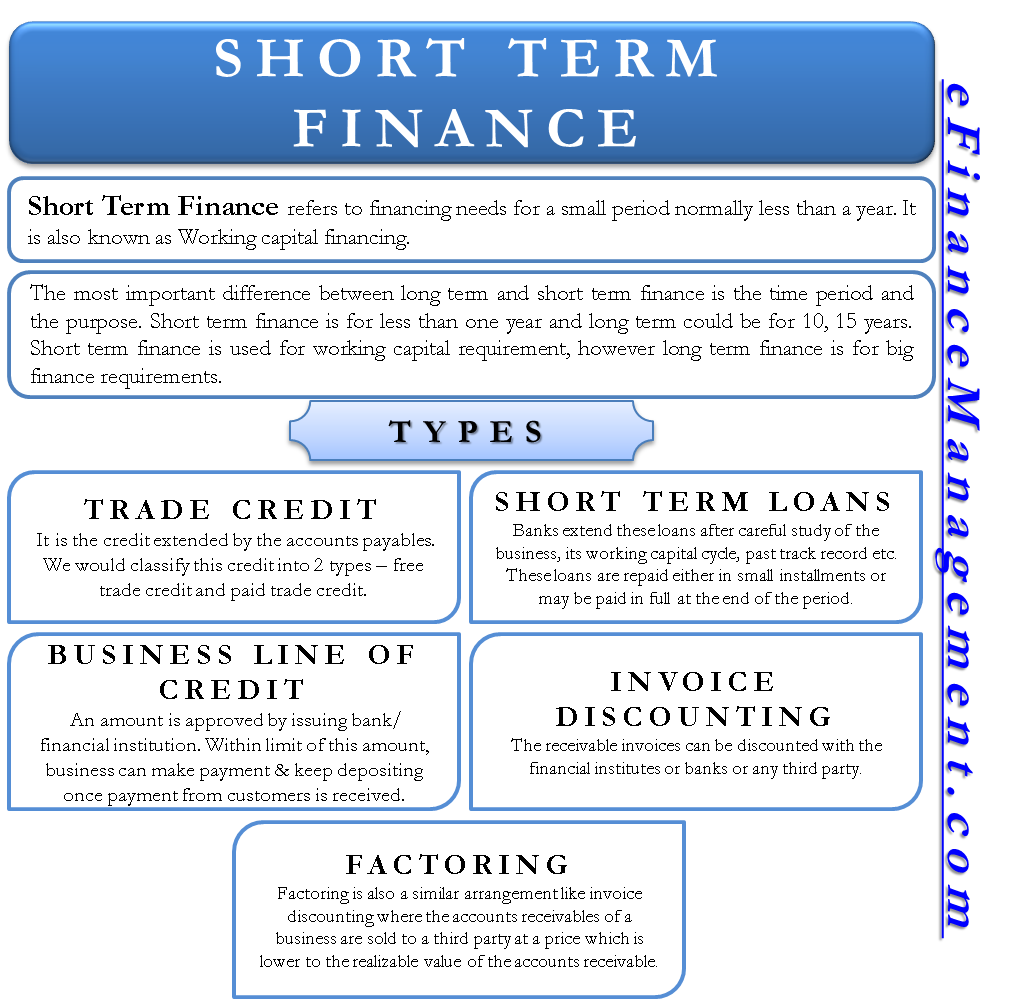

Short Term Finance Types Sources Vs Long Term Efinancemanagement

Revolving Credit Facility Efinancemanagement

Loan Structure Overview Components Examples

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Delayed Draw Term Loan Ddtl Overview Structure Benefits

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

The Benefits Of Long Term Vs Short Term Financing

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

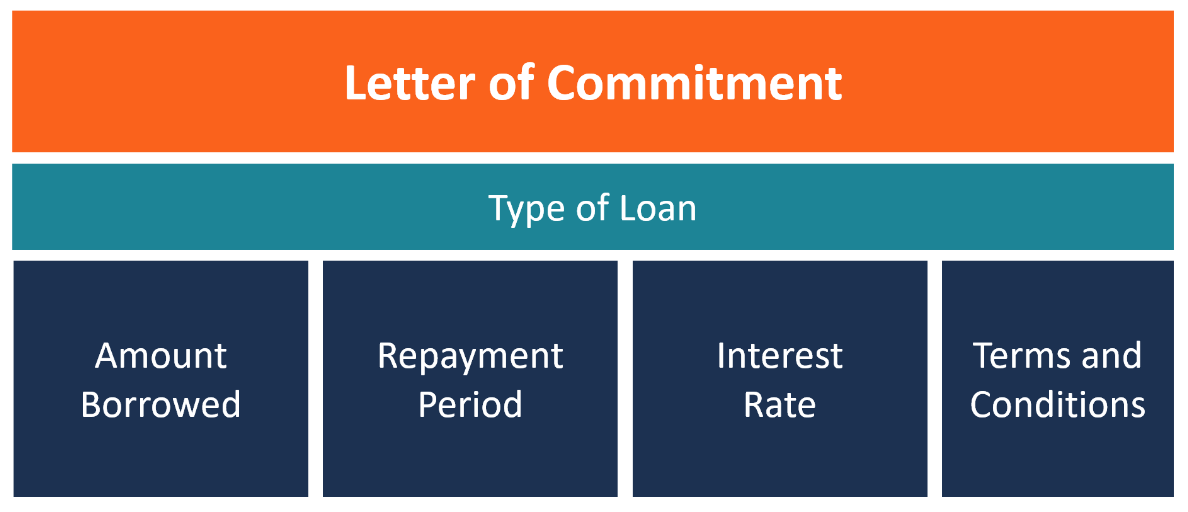

Letter Of Commitment Overview Example And Contents

Types Or Classification Of Bank Term Loan And Features Lopol Org

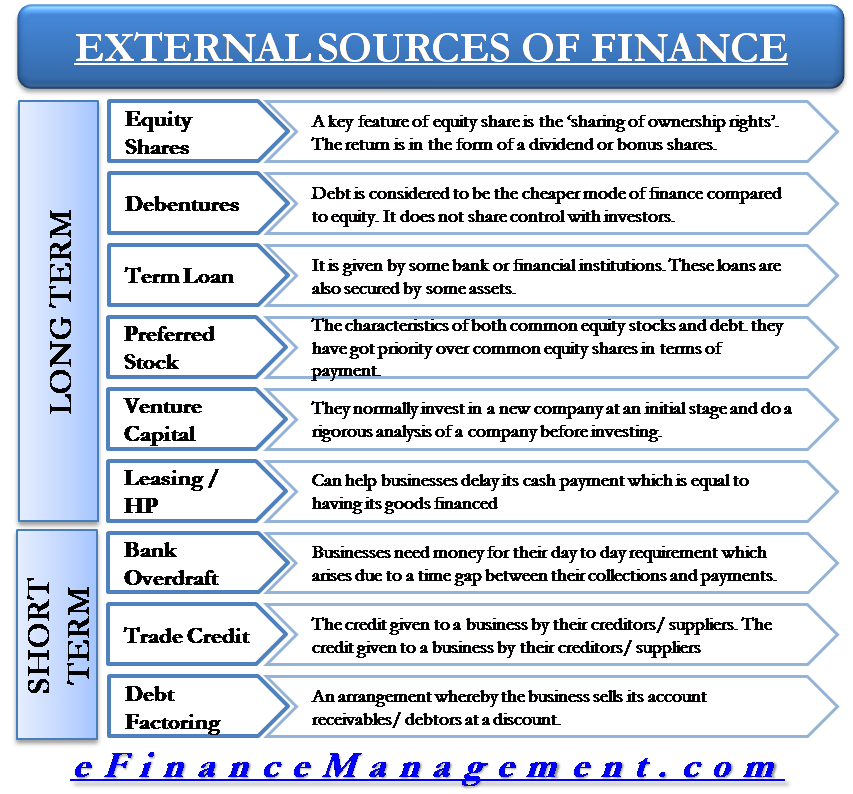

External Sources Of Finance Capital

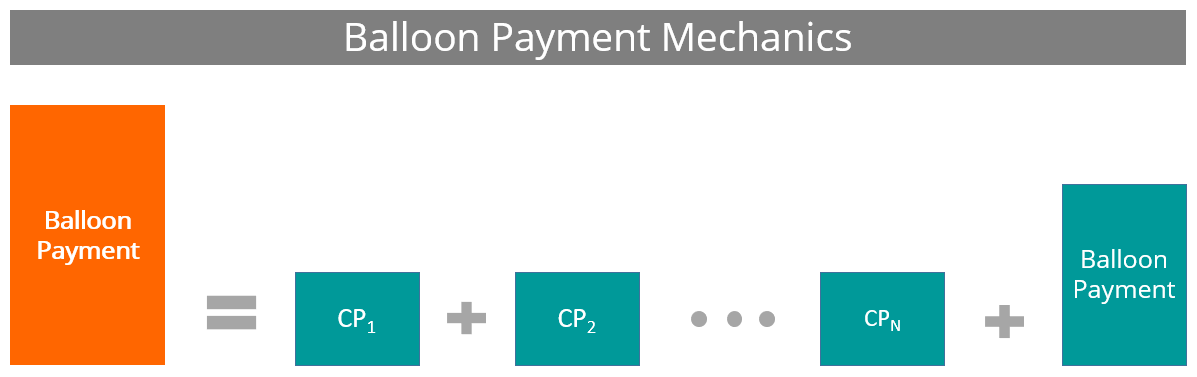

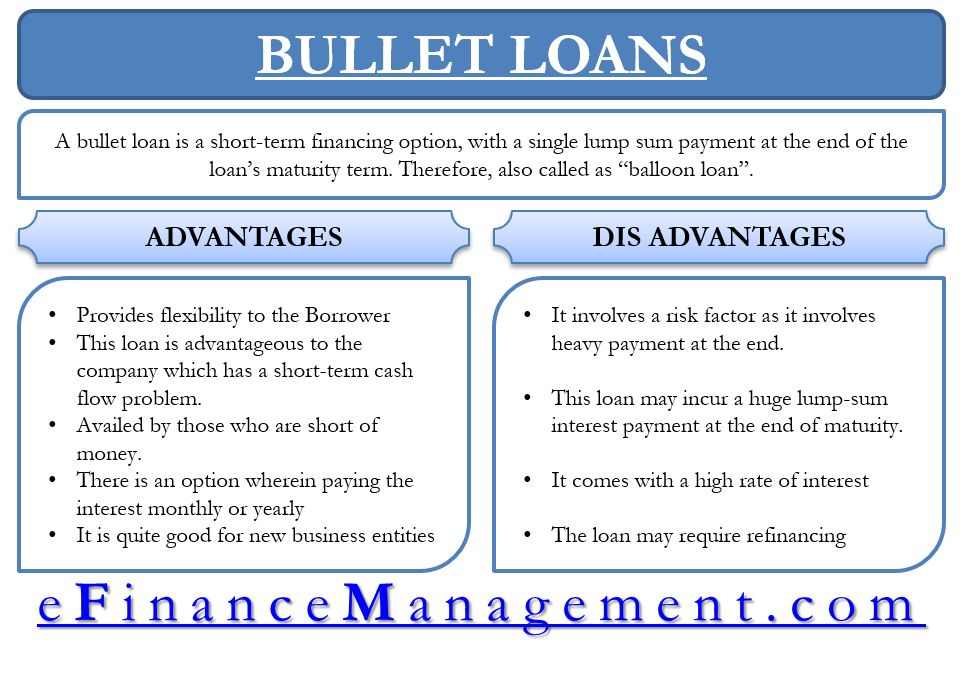

Bullet Loan Efinancemanagement